COTReportLegacy

The installation of the Technical Analysis Package is required in order to access this indicator.

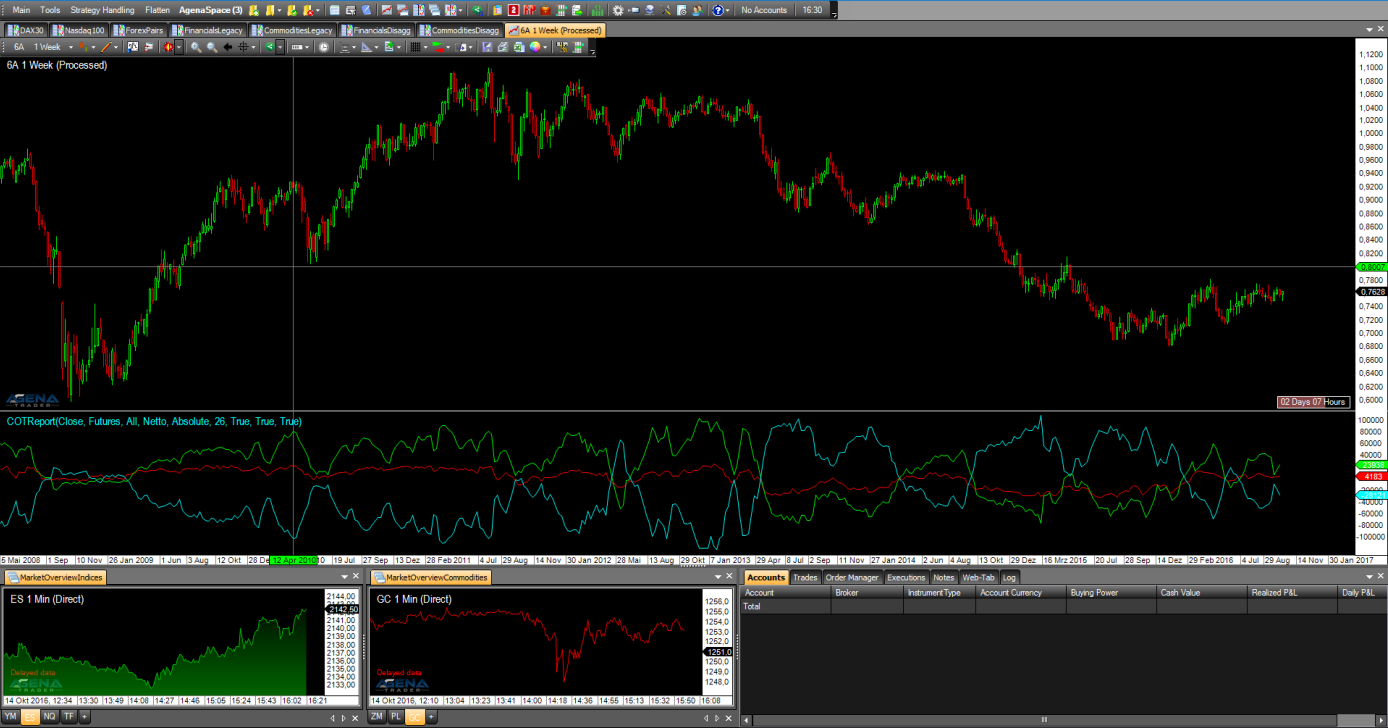

Description

This indicator is the core element of the COT analysis, with which one can directly display the pure data that the indicator reads from the reports published weekly by the CFTC (www.cftc.gov/CommitmentsofTraders). The published reports can be viewed by every market participant. The legacy data is published in the so called short reports you can find on the CFTC-website. The following parameters are available in the COTReportLegacy:

Comparative Period: with this setting, you can enter a comparative period with which the stochastic display is calculated (=StochasticPeriod). The system only triggers this parameter when “IndexType = Stochastic” is set.

CotType: under [All/Other/Old], select which contracts should be used for the display; more details are available HERE

IndexType: choose between [Absolute/Stochastic] as to how the values should be outputted.

Absolute = the values are outputted in whole numbers, just as they are read out from the reports.

Stochastic = the values are outputted and calculated as an oscillator with values between 0-100. With the ComparativePeriod, you can set with which period the Stochastic should be calculated.

ReportType: under this parameter, you select whether the data from the reports should be read out only for futures, or for futures + options.

ReturnType:

Net: outputs the net position (=LongContracts – ShortContracts) of the selected market participants

Long/Short: outputs the long i.e. short contracts of the selected market participants

OI: outputs the total OpenInterest of this instrument; for a more precise and advanced display of the OpenInterest, please use the indicator OpenInterestLegacy

ShowCommercials: select [True] if you would like to have the data for the Commercials displayed. For detailed information on the definition of which market participants are classified as Commercials, please have a look HERE

ShowNonCommercials: select [True] if you would like to have the data for the NonCommercials displayed. For detailed information on the definition of which market participants are classified as NonCommercials please have a look at the link provided above.

ShowNonReportables: select [True] if you would like to have the data for the NonReportables displayed. For detailed information on the definition of which market participants are classified as NonCommercials please have a look at the link provided above.

Parameters

to be announced

Return value

to be announced

Usage

to be announced

Visualization

Example

to be announced

Last updated